In Channy is the chairman of the Association of Banks in Cambodia (ABC). He also serves as president and group managing director of public-listed Acleda Bank Plc. Hean Rangsey

Cambodia’s banks and financial institutions are least affected by the economic conditions but a prolonged pandemic could knock the wind off its wings

The banking industry in Cambodia has remained resilient over the months, having bucked the crippling effects of the coronavirus pandemic on the back of strong fundamentals, and stimulus measures implemented by the government and central bank.

But industry players are uncertain whether this buoyant predicament, where profits are estimated to have risen about 20 per year-on-year in the first half of 2020, will sustain if current economic conditions prolong.

The risk level is being monitored by financial institutions as pressure on three economic pillars – tourism, construction and exports – piles on, a move echoed by Moody’s Investors Service Inc, which opined that the global outlook for banks has turned “decisively negative”.

“At this stage, nobody expects the global economy to fully recover by 2021. [The impact on the sectors] will certainly affect bank portfolios,” said In Channy, chairman of the Association of Banks in Cambodia (ABC).

He cautioned that the increase in profit is to be compared with an average year-on-year profit growth over the past eight years.

“[When set against each other] growth has significantly slowed in the first two quarters of 2020 [although] profitability is still positive,” Channy said.

This is so, seeing that profitability also stems from banks continuing to earn interest income from existing restructured loans.

Cambodia’s monetary measures are unlike its regional peers, Thailand, Malaysia and Singapore, which granted a grace period of six to 12 months on principal and interest payments.

Undeniably, National Bank of Cambodia (NBC)’s decision was a saviour for the players in the sector, so to speak. For instance, public-listed Acleda Bank Plc, where Channy serves as president and group managing director, maintained a steady year-on-year rise in net interest income (NII) and profit. It posted a 10.2 per cent growth in NII at $177.1 million in the cumulative six months period ended June 30, 2020 as opposed to $160.7 million last year.

Source: Moody’s Investors Service Inc

Total loans and advances inched up 0.7 per cent to $3.87 billion in the same period from $3.85 billion in 2019.

Taken together, this growth partially contributed to a 9.6 per cent gain on Acleda’s net profit of $63.7 million for the first half this year compared to $58.2 million a year ago.

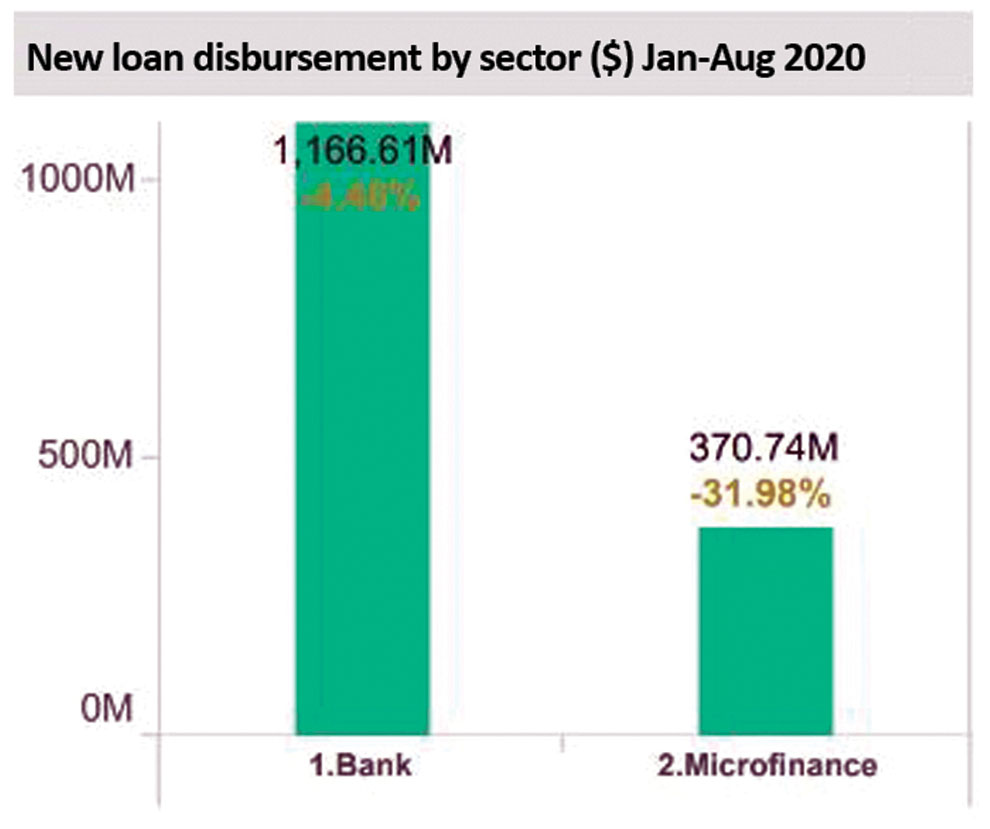

Overall, loans in the Kingdom to consumers and businesses climbed nearly 20 per cent to $34.4 billion as of June 30 this year, partly spurred by the low interest loans offered under Covid-19 circumstances. Although in August it dipped to $1.6 billion from $1.8 billion a year ago.

Bank and financial institution assets totalled $54.1 billion in the first half of this year. They consisted of loans (about 60 per cent), deposits with the central bank (22 per cent) and loans to other financial institutions (10 per cent). The remaining components were made up of cash, gold, securities and fixed assets.

At the same time, overall deposits expanded by 12.3 per cent to $30.5 billion while bank capital gained 10.8 per cent at $6 billion.

Looking at the figures, it is no surprise that the financial institution sector is none too perturbed as oftentimes it is one of the most stable sectors in a country.

Source: Credit Bureau of Cambodia

Source: Credit Bureau of Cambodia

“Banks by and large are robust, thanks to 10 years of broadly benign economic conditions and relentless regulatory pressure to reinforce balance sheets, most banking systems are in good shape.

“They have the capacity to withstand an inevitable rise in bad debts over the coming months as individuals and companies begin to default,” Moody’s said in a note on September 24.

But one cannot dismiss the notion that the sector is not without risks.“The key threat to banks is a meaningful second wave of the pandemic, leading to either a new round of blanket lockdowns, with further severe implications for economic activity, or to self-imposed changes in behaviour with a similar if milder effect.

“In this case, bank creditworthiness would likely suffer a more durable erosion,” Moody’s wrote.

Stimulating the sector

For now, regulatory policies that were enhanced by NBC after the 2008 global financial crisis have somewhat helped to shore up requirement reserves and capital conservation buffers against any system shock.

Based on its data, the solvency ratio and liquidity coverage of banks stood at 24 per cent and 155.7 per cent, respectively, last year, with the latter indicator meeting the requirement under Basel III, a measurement to withstand impacts in a crisis.

As for profitability vis-a-vis return on assets (ROA) and equity (ROE), both segments improved by 1.9 per cent and 9.8 per cent, respectively.

But, the existing policies alone would not have supported the sector in a depressed economy, which is unlike preceding financial crises since the 1990s.

Credit Bureau of Cambodia (CBC) CEO Oeur Sothearoath alluded that here is where the Covid-19 measures implemented by NBC and the government to reduce the burden on consumers inadvertently helped to keep the industry above water.

Source: National Bank of Cambodia (Economic and Monetary Statistics, June 2020)

For example, NBC’s monetary measures eased some obligations including the deferment of the 50 per cent target on capital buffer till 2021 and the cutting of interest rates on liquidity-providing collateralised operation (LPCO) to 2.5 per cent from three per cent.

“It helped to keep up liquidity and enabled financial institutions to keep lending to businesses in need of additional funds,” Channy told The Post.

Every month, the NBC conducts two LPCO auctions. This year, $168 million would have been put on offer monthly. (LPCO is a scheme which helps to inject liquidity in local currency into the sector).

Based on the availability of funds from January to September and given the current high demand by financial institutions for the riel, Channy opined that all the funds would have been absorbed by the sector.

“In total, around 5.8 trillion riel [$1.4 billion] would have been disbursed [this year] and about 4.2 trillion riel [$1 billion] remains outstanding and floating within the market,” he said.

In comparison, some $58.2 million was disbursed to banks via LPCO in the first half of 2018.

Loan restructure in 2021?

The circular on loan restructuring at the height of the coronavirus pandemic in March also enabled the financial institutions restructure loans that were otherwise in default or doubtful.

Most of the restructuring took the form of payment moratoriums on outstanding principal.

“[Therefore] borrowers only pay interest for the [revised] term which normally does not exceed six months. Those measures ensured that banks still receive interest income while also not downsizing or downgrading the [loan] portfolio,” he said.

As of August 31, 2020, up to $3.6 billion worth of loans had been restructured, CBC data showed.

But because the restructure is based on applications by borrowers and strict vetting by lenders, the pace fell in the following months after June when 44,500 loans valued around $2.2 billion were revised.

CBC’s Sothearoath explained that on the part of a lender, policies are devised to evaluate a borrower’s credit history and that they are impacted by Covid-19 before the restructuring is done.

“The prolonged debt exposure of borrowers will really depend on the type of restructuring offered by the lender, the borrower profile and how the borrowers are using the restructured loans,” he said.

On the ground though, the situation is stark as scores of borrowers, particularly those with credit from microfinance institutions (MFIs), claim that they were unable to appeal for some leniency on payments.

In the past, NBC no less, as well as international financial institutions, local non-governmental organisations and Human Rights Watch have repeatedly highlighted the troubling spike in MFI debts, as it could trigger a systemic risk in the banking sector due to high credit growth.

Data from the 2017 Cambodia Socioeconomic survey shared by World Bank revealed that about 40 percent of rural households were indebted.

Source: Credit Bureau of Cambodia

Source: Credit Bureau of Cambodia

The survey stated that outstanding loans and credits from the MFI (and credit operating) sector accounted for 52.3 percent of debt owed by rural households.

By the end of 2019, there were 2.6 million MFI debtors with a collective loan value of over $10 billion in Cambodia, according to Cambodia Microfinance Association (CMA).

These collateralised loans stand at $3,804 per capita, which makes Cambodians the largest class of micro credit borrowers in the world.

Latest figures by CMA indicate a dip in borrowers to 2.1 million with a total outstanding loan of $7 billion.

However, CMA spokesman Kaing Tongngy said although non-performing loans (NPL) of the entire financial sector was 2.3 per cent in August compared to 1.3 per cent in January this year, it is considered sustainable by global standards in the industry. Overall, NPL stands at 2.5 per cent.

“In normal circumstances, loan restructuring may be considered as a NPL but during a pandemic, it is [deemed] a normal performing loan based on NBC’s circular,” Tongngy said.

He claimed that while many of MFI clients have “recovered” from the impact of the pandemic, there were still some, particularly those in the tourism sector who remained impacted.

“We are still discussing with members and stakeholders on the possibility of continuing [the] loan restructure [scheme] till the end of 2021 for the impacted clients,” Tongngy said.

The MFI sector has a total of 2.8 million depositors with 3.8 billion savings accounts.

Cambodia has a high proliferation of financial institutions in the region. Last year, NBC said there were 47 commercial banks consisting of 17 local banks, 17 subsidiaries and 13 foreign branch banks.

In addition, there are 15 specialised banks, seven microfinance deposit-taking institutions, 76 microfinance non-deposit taking institutions, 245 rural credit institutions, and 15 financial leasing companies.

It has a thorough representation for various financial needs in the country for borrowers and depositors, yet financial literacy in rural areas remains comparatively low.

Are banks out of the woods?

Channy does not think so, given the continuous negative economic outlook. In order to keep liquidity and not face a wave of NPLs, financial institutions are subject to continuous stimulus measures.

Having said that, profits through 2020 will be largely contributed by the stimulus measures but as they are currently in place till the end of the year, banks are likely to see a more significant negative impact on portfolios and profits in 2021.

“On average, banks can be expected to end 2020 with a healthy profit on the books,” he said.